Solutions

TRADITIONAL ERP

Dynamics GP

Enavate AI for Dynamics GP

GP Support & Upgrades

Dynamics GP Health Check

Move GP to the Cloud

Migrate GP to Dynamics 365

Dynamics SL

Dynamics SL Health Check

Dynamics NAV

Dynamics NAV Health Check

CLOUD HOSTING

Microsoft Azure

CRM

Dynamics 365 for Sales

PRODUCTIVITY

Microsoft Power Platform

Power BI

Services

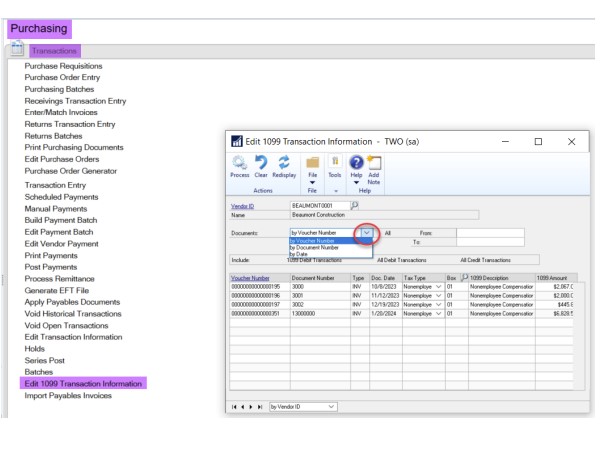

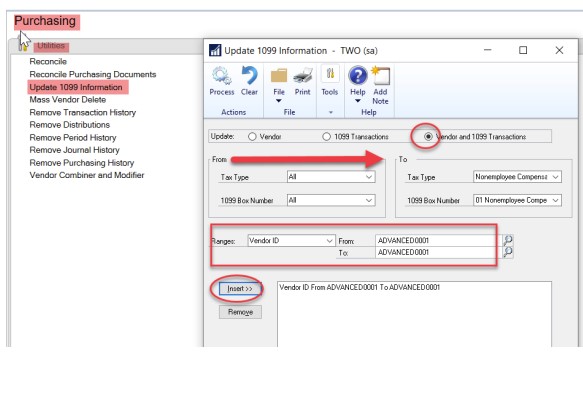

In the FROM section, it is referring to what is currently assigned to the vendor and the transactions.

In the FROM section, it is referring to what is currently assigned to the vendor and the transactions.  TO – means what it will be changed to

TO – means what it will be changed to